Gross profit for the job is calculated as the sales revenue collected from the customer less the cost of the goods sold. In a job-order costing system, cost of goods sold represents total production costs, e.g. direct material, direct labor, and manufacturing overhead. Manufacturing overhead costs are applied to the jobs in process using a predetermined manufacturing overhead rate. The predetermined manufacturing overhead rate is discussed in detail in subsequent sections of this chapter.

2: Describe and Identify the Three Major Components of Product Costs under Job Order Costing

Traditional billboards with the design printed on vinyl include direct materials of vinyl and printing ink, plus the framing materials, which consist of wood and grommets. The typical billboard sign is 14 feet high by 48 feet wide, and Dinosaur Vinyl incurs a vinyl cost of $300 per billboard. Indirect labor costs are included in overheads, such as administrative overhead, factory overheads, or sales and distribution overhead. It is one of the significant components of the product cost of the company where the other components of the product cost include direct material cost and manufacturing overhead costs. On the other hand, the indirect labor cost is the cost that cannot be traced to a single job or a single unit of product as such cost is usually related to the production as a whole. For example, the salary of the quality control and inspection personnel usually contributes to all units of goods in the production.

Accounting

Remember that keeping track of direct and indirect labor expenditures can benefit even service businesses. While it may appear to be a lot of extra work, especially for a small business, effectively managing these charges will provide you with a much clearer picture of your company’s financial health. However, if you’re not certain if an employee’s labor costs are direct or indirect. Then, you must check if you can connect them to a particular product or service. As you can see from the chart above, an accountant at a manufacturing company is considered indirect labor because they have no direct involvement in the production of a product.

Direct and indirect labor cost

With this integrated feature, you can set up a central terminal or allow your employees to clock in and out right from their mobile devices. Once you’ve identified your cost and how it applies to your rate of production, you can tweak any number of variables and procedures within your business to achieve the result you’re after. For this example, we’ve calculated that our employee works 2,000 out of the total 2,080 hours annually. Direct labor cost is one of the key components of fundamental business benchmarks such as efficiency and profitability.

- Consulting, law,and public accounting firms use job costing to measure the costs ofserving each client.

- As direct materials, direct labor, and overhead are introduced into the production process, they become part of the work in process inventory value.

- For example, in furniture making, the wages paid to the carpenter is direct labor cost.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Whereas, an organization that relies on machines instead of laborers might use machine hours as the allocation base.

The company assigns overhead to each job onthe basis of the machine-hours each job uses. Overhead is assignedto a job at the rate of $ 2 per machine-hour used on the job. Job16 had 875 machine-hours so we would charge overhead of $1,750 (850machine-hours x $2 per machine-hour).

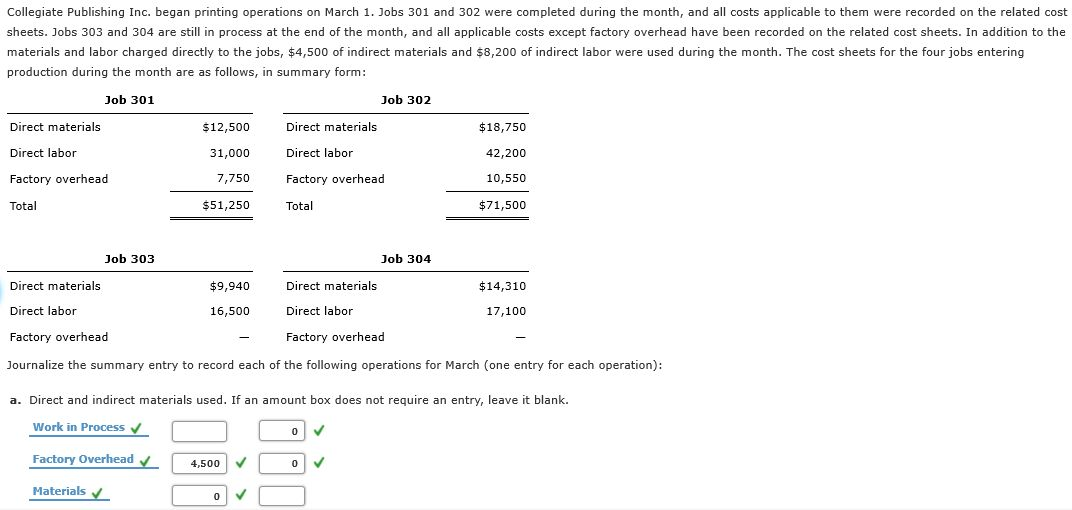

The costs for all raw materials—direct and indirect—purchased to manufacture the product are debited to the Raw Materials account. The credit for raw materials costs is typically recorded in the Cash account or a related liability account. Direct materials are raw materials that can be easily and economically traced to the production of the product. Indirect materials are raw materials that cannot be easily and economically traced to the production of the product, e.g. glue, nails, sandpaper, towels, etc. In this section, you’ll be assigning direct material and direct labor costs to a job.

Despite the fact that both of your employees contribute significantly to the success of your practice, they are both classed as indirect labor because none provides direct client service. Moreover, businesses must occur in a regular cycle to avoid cash flow issues. Further, if a company is seasonal and needs extra labor during peak seasons. Then, business controllers must have enough cash on hand to cover the cost rise. Many cash concerns linked with labor costs can be avoided if a corporation planned effectively. Furthermore, if you work in sectors such as accounting, human resources, finance, or senior management, the topic of labor costs is just something you can’t ignore.

The Direct Labor Cost is classified as product cost, inventory cost, prime cost, or a conversion cost (in case of manufacturing overhead allocation). Do you know of a restaurant that was doing really well until it moved into a larger space? Often this happens because the owners thought their profits could handle the costs of the increased space. Read advice from restaurant owner John Gutekanst about the importance of understanding food costs and his approach to account for these in his pizzeria.

Indirect labor, such as the salaries of factory management, cannot be easily traced to products. Therefore, these expenses are debited to the manufacturing overhead account and credited to the wages payable account. As jobs are completed, these overhead costs will be applied to products retained earnings in accounting and what they can tell you through an allocation process. The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. The activity used to allocate manufacturing overhead costs to jobs is called an allocation base7 .

According to C.I.M.A. London, Indirect labor cost means “wages cost other than direct wages”. In other words, indirect labor expenses are those that cannot be directly linked to cost units. Like direct labor, a significant part of total indirect labor cost consists of fringe benefits, employer’s contributions and payroll taxes etc. Any expense or cost caused by non-production workers like office, administrative or security personnel etc. can’t be regarded as direct labor cost.

Direct labor can be analyzed as a variance over time, across products, and in relation to other process, equipment, or operational changes. The main difference between direct and indirect labor costs is the underlying fact that direct labor can be directly attributed to a certain product. On the other hand, it can be seen that indirect labor cannot be directly attributed to any given product. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. All these costs are recorded as debits in the manufacturing overhead account when incurred.